Blockchain technology may become an important part of the technology landscape. This article explains exactly how blockchain works and its implications for small businesses.

In this article

Small to midsize enterprises (SMEs) ideally should have a critical set of tools to help them manage day-to-day operations. This includes cybersecurity software, productivity software, and accounting software, for example. Beyond this are newer technologies, such as blockchain, that may not be necessary now, but may form an important part of a business’s future strategy.

In this article, we explore what blockchain is, how it works, and how it can help SMEs in Canada.

What is blockchain technology?

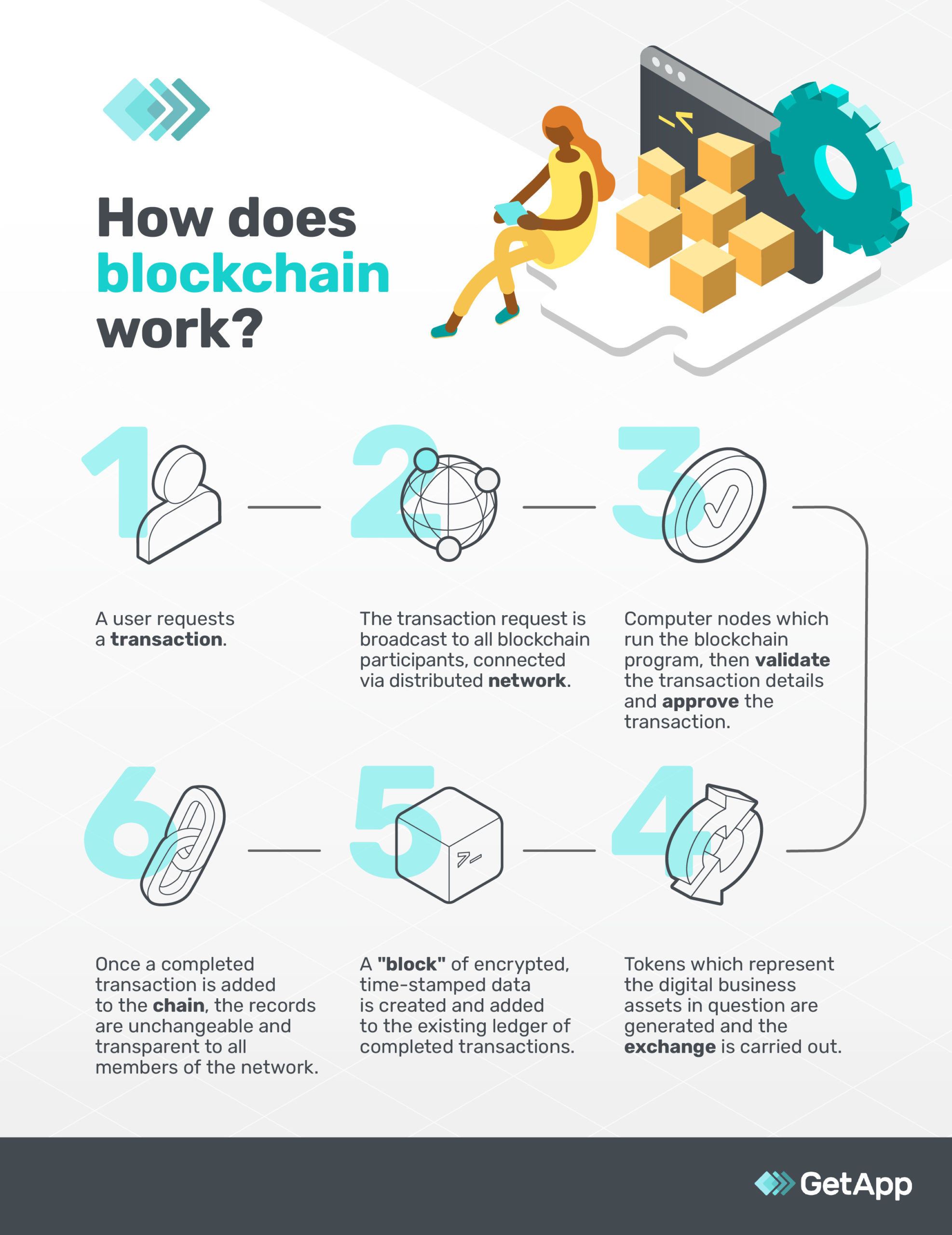

Essentially, blockchain is a type of database —a way of storing and organizing information. Traditional databases usually store records in one place, whereas blockchain technology typically stores information across several computers —known as ‘nodes’— on a distributed network.

Another important difference —and the feature that gives blockchain its name— is the idea of a chain of blocks. Information is grouped into blocks of a fixed size. Once a block is full, it is locked and cannot be changed. People often describe the blocks as ‘immutable’ when talking about blockchain. As each block is locked, it is linked to the previous block, forming a fixed chain of data, which is then shared across the distributed nodes.

This structure gives the blockchain one of its most significant theoretical benefits: trust. Each blockchain contains a locked, sequential series of data blocks, and a record of this sequence is shared across computers belonging to different parties. If one party were to delete or manipulate the data, the remaining nodes would be able to detect the error, recover only the correct data, and therefore ignore that unauthorized change.

What is blockchain used for?

One of the most obvious applications of blockchain technology is as a trustworthy chronological record of events. This provides several use cases —practical applications for blockchain technology— that are relevant to SMEs, and we discuss some of them below.

Validating ownership of cryptocurrency

The first and possibly best-known use of blockchain technology is cryptocurrency. In this case, a blockchain is often referred to as a distributed ledger, in that it is a record of transactions made using that currency shared across a network of computers.

The basis of NFTs

Another emerging use case, and one that has surged in popularity recently, is as the basis of non-fungible tokens (NFTs). Here, blockchain acts as a record of ownership for assets, which could be physical, like artwork or real estate, or digital, like music, videos, images, e-books, or even a user-created character in a computer game.

Powering smart contracts

Smart contracts are another compelling use case, but may have gained less real-world traction. If we think of a contract —such as the paperwork required when buying or selling a house— as a series of steps that each party agrees to undertake during the process, a blockchain could act as a trustworthy record of who did what and when. The idea here is that the smart contract could potentially automatically mediate between the parties with minimal paperwork and help reduce the costs associated with lawyers.

Cryptocurrency for SMEs

It is hard to escape some of the hype around cryptocurrency —often called ‘crypto’ for short— even though adoption may still be fairly low. According to Ipsos Canada, 14% of Canadians own cryptocurrency of some sort, but this has grown from 3% in 2016.

Unlike traditional currencies like dollars or pounds —which are backed by central institutions like the Bank of Canada— cryptocurrencies usually gain their legitimacy from a distributed ledger like blockchain. Everyone shares the immutable record of transactions, plus transactions and ownership are encrypted —hence the ‘crytpo’ in the name— adding further security.

The value of cryptocurrencies like Bitcoin is highly volatile. In the 13 years that Bitcoin has existed, one Bitcoin has, at different times, been worth less than a cent and more than US$68,000. This has attracted huge speculation and consequently may have driven adoption.

SMEs may want to consider accepting crypto as a means of payment. This is gaining traction in Canada, with companies like the auto dealer HGreg already accepting it. If you have an online store built with Shopify, you can also enable payments in cryptocurrencies and start accepting them likely right away.

But there’s an old saying that the way to get rich in a gold rush is to sell shovels, and that’s what some organizations may be doing right now, proverbially. Rather than investing in the cryptocurrencies themselves, some companies are providing the ancillary products and services that enable the crypto economy to function. They’re building digital wallets, for example —secure online or physical storage where crypto users can keep the keys that provide access to their coins.

Some such companies may have also set up crypto exchanges that enable people to buy and sell currencies and developed payment processing software that allows businesses to take crypto as payments. All these services cater to the expanding crypto market without the direct volatility associated with the value of the currencies.

NFTs for SMEs

Just as blockchain technology serves as a record of who owns virtual coins, it can also serve as a record of ownership for other assets. While cryptocurrencies are ‘fungible’ —one Bitcoin will always be equal in value to another Bitcoin and they can therefore be traded— every non-fungible token (NFT) is unique.

Each token serves as proof of ownership of an asset. This might be physical —like a house or painting— or digital —like a character in a computer game or a ‘moment’ from an NBA basketball game. Sometimes, the terms of the NFT state that the owner doesn’t actually own the intellectual property of the digital asset, they just have the right to display it in limited circumstances, as discussed in an article by Caravel Law. This has led to some confusion about use cases for the technology.

Investors may be excited about the possibility of NFTs making markets more efficient by eliminating brokers and agents. Artists, for example, can sell their artwork as NFTs or even split the ownership up into multiple NFTs, which can be sold as shares in the work.

Where SMEs may be interested is the idea that a digital record of an asset can be tracked through time, and that record could be fixed on a blockchain. Goods in a supply chain could be a good example of this. NFTs may be gaining in popularity now, and, just like crypto, there is a lot of price volatility as reported by Forbes, especially around ‘digital collectables’. For now, it may make sense to wait until some more stable use cases emerge.

Smart contracts for SMEs

Rather than a record of ownership, smart contracts based on blockchain technology use the idea of an immutable chronological record of events to trigger certain functions. They are often referred to as ‘self-executing’ because they automate the steps required for a contract to be fulfilled. They also have the advantages of being transparent and, if required, anonymous.

Take the example of a house purchase. A smart contract can be set up to automatically transfer a property deed into the buyer’s name as soon as the funds have cleared electronically. If somebody misses a deadline or fails to complete their obligations under the contract, financial penalties could be triggered. All this can occur immediately and in some cases even perhaps without the need for an intermediary like a lawyer. A PYMNTS.com report suggests that they can even work across borders and legal systems.

Smart contracts are already in place at large enterprises like Home Depot, which uses them to manage supplier disputes. SMEs should be cautious, however. According to a study by SSRN, the current status of smart contracts under Canadian law is still not clear, and you should seek legal advice before entering into one.

Blockchain for SMEs: is it worth it?

Blockchain is a potentially versatile technology that may underpin many other exciting new developments. Like any technology, it pays to keep a close eye on how it develops, because it could be useful to your business.

However, the worlds of crypto, NFTs, and smart contracts are also fast-moving and perhaps not very well regulated. Diving in without a full understanding of the details, risks, and rewards would not be wise.

This article is intended to inform our readers about business-related concerns in Canada. It is in no way intended to provide financial advice or to endorse a specific course of action. For advice on your specific situation, consult your accountant or financial consultant.