KYCScoring

KYCScoring

About KYCScoring

KYC Scoring offers a platform that allows businesses to quickly and easily get their customers' financial history, see how they are paying back their loans, and verify customer identities in accordance with GDPR regulations. It helps businesses with everything from customer onboarding to KYC profiling, business intelligence and real-time monitoring.

KYC Scoring provides a framework for KYC compliance that can help users identify risk and verify customer information globally. The system offers live data which means it is always up-to-date and can keep up with any changes in legislation such as GDPR.

Pricing starting from:

£125.00/month

- Free Version

- Free Trial

- Subscription

Key benefits of KYCScoring

INSTANT ACCESS

Our revolutionary KYC software provides you with instant access to real-time financial information on loan applicants. This allows you to make more informed decisions regarding loans with previously unavailable, live data right at your fingertips

SAFE AND SECURE

We understand the importance of security when it comes to company and client data, and are fully GDPR compliant and ISO certified. Our system is not a database, and does not store your financial information, it simply requests the relevant data when a client is queried.

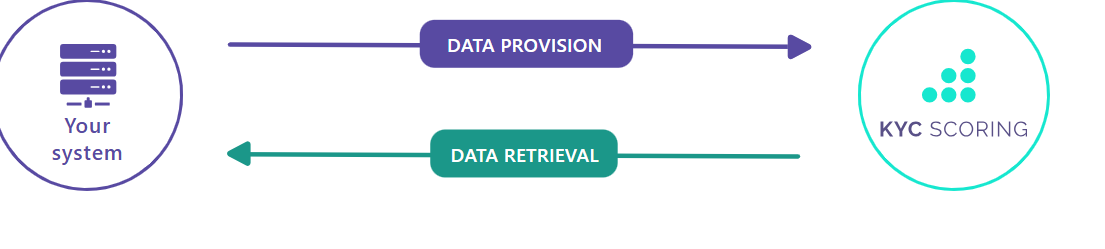

EASY INTEGRATION

KYC Scoring will integrate seamlessly with your current system. Sign up and you'll be carrying out live KYC checks in no time, no unnecessary hassle required.

COLLABORATIVE APPROACH

Our KYC verification platform enables collaboration between lending companies, through the sharing of live financial data on clients, such as active loans and debt owed.

Typical Customers

- Freelancers

- Small Businesses (2-50)

- Mid-size Companies (51-500)

- Large enterprises (500 and more)

Deployment

- Cloud-based

- On-premise

Supported Languages

English

Pricing starting from:

£125.00/month

- Free Version

- Free Trial

- Subscription

Images

Features

Total features of KYCScoring: 9

Alternatives

Overall rating

Filter by

0 Reviews

This service may contain translations provided by google. Google disclaims all warranties related to the translations, express or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose and noninfringement. Gartner's use of this provider is for operational purposes and does not constitute an endorsement of its products or services.

There are currently 0 user reviews for KYCScoring

KYCScoring FAQs

Below are some frequently asked questions for KYCScoring.Q. What type of pricing plans does KYCScoring offer?

KYCScoring offers the following pricing plans:

- Starting from: £125.00/month

- Pricing model: Subscription

- Free Trial: Not Available

Q. Who are the typical users of KYCScoring?

KYCScoring has the following typical customers:

Self Employed, 2–10, 11–50, 51–200, 201–500, 501–1,000, 1,001–5,000

Q. What languages does KYCScoring support?

KYCScoring supports the following languages:

English

Q. Does KYCScoring support mobile devices?

KYCScoring supports the following devices:

Q. What other apps does KYCScoring integrate with?

We do not have any information about what integrations KYCScoring has

Q. What level of support does KYCScoring offer?

KYCScoring offers the following support options:

Email/Help Desk, FAQs/Forum, Phone Support

Related categories

See all software categories found for KYCScoring.