It can be hard for small to midsize enterprises (SMEs) to stay on top of eCommerce and payment trends. New technology is constantly changing the sector, so we surveyed over 1,000 consumers in Canada to find out more.

What we will cover

As our shopping habits have changed, so too have the ways in which we pay for goods and services. Both online and in store, consumers have a choice in where they shop and how they pay. Small to midsize enterprises (SMEs) should understand how the public’s attitudes to eCommerce, payment, and security are changing in order to meet their needs.

To understand more about how consumers in Canada shop online we surveyed more than 1,000 adults aged under the age of 75 who make internet purchases at least once a month. You can find a full methodology at the bottom of this article.

What are the most popular platforms to buy online in Canada?

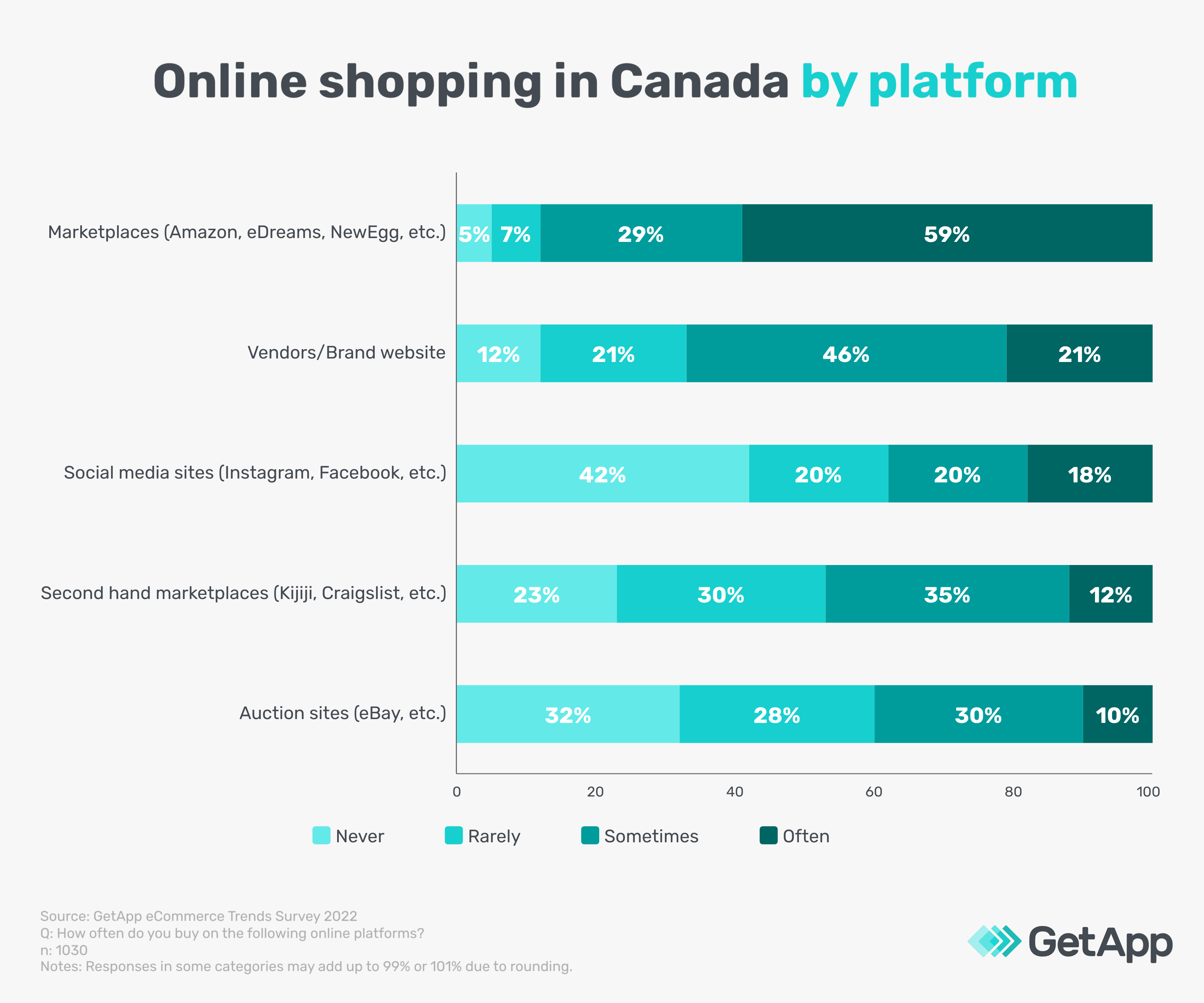

We asked participants in our survey how often they purchased from certain types of online platforms. The most frequently used were marketplaces (for example Amazon, eDreams, or NewEgg.) 59% said they often shop on these types of websites, making it the only category that a majority of respondents said they use ‘often’.

A plurality ‘sometimes’ use vendor or brand websites (46%) and secondhand marketplaces such as Craigslist or Kijiji (35%). Respondents use online auction sites like eBay less frequently, with a majority saying they ‘never’ (32%) or ‘rarely’ (28%) use them. And shopping through social media is also less common — 42% of respondents say they never use it to make purchases.

What technology do Canadians use to shop online?

It may not come as a surprise, given how prevalent and user-friendly they are, but participants in our survey were more likely to use hand-held devices to do their online shopping than a traditional computer. 43% say they are most likely to use a smartphone, and 9% prefer a tablet. The remainder (48%) mainly use a laptop or desktop computer.

Around three-quarters of the Canadian consumers we surveyed download dedicated apps for the eCommerce sites they use. 10% say they do this whenever an app is available, 49% say they do so only for stores they use frequently, and 17% do so in order to take advantage of a special offer or discount.

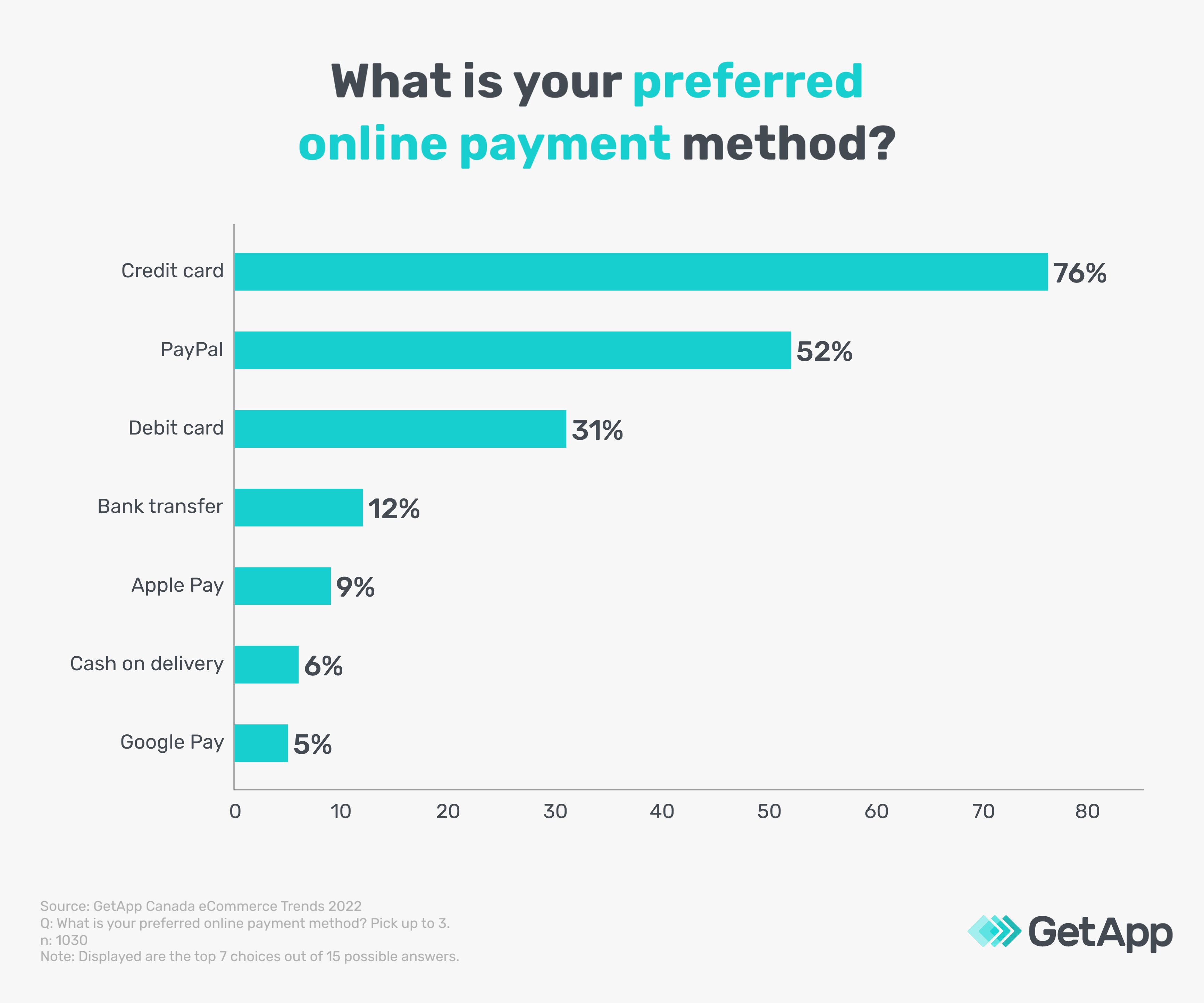

When it comes to payment for online shopping, consumers in Canada use a wide variety of technologies. However, three were clearly more popular than others.

Credit card, PayPal, and debit card attracted far more responses than other methods, although the broad spread of responses across technologies suggests that consumers are exploring the market as new payment methods emerge.

For example, 9% use Apple Pay and 5% use Google Pay — services that often come included with smartphones. Meanwhile, 12% say they prefer to use the more established bank transfer option and 6% favour cash on delivery.

Buy now, pay later services, which are sometimes offered as payment methods on eCommerce sites and provided by third parties such as Klarna, AfterPay, or PayBright, are in the top three methods for 4% of respondents.

What makes a consumer-friendly online shopping experience?

Consumers are faced with a huge range of choices when shopping online, and brands can find it hard to compete based on product or price alone. Offering the best customer experience can be a differentiator, with a smooth browsing process, seamless transactions, and fast delivery all helping to attract repeat customers.

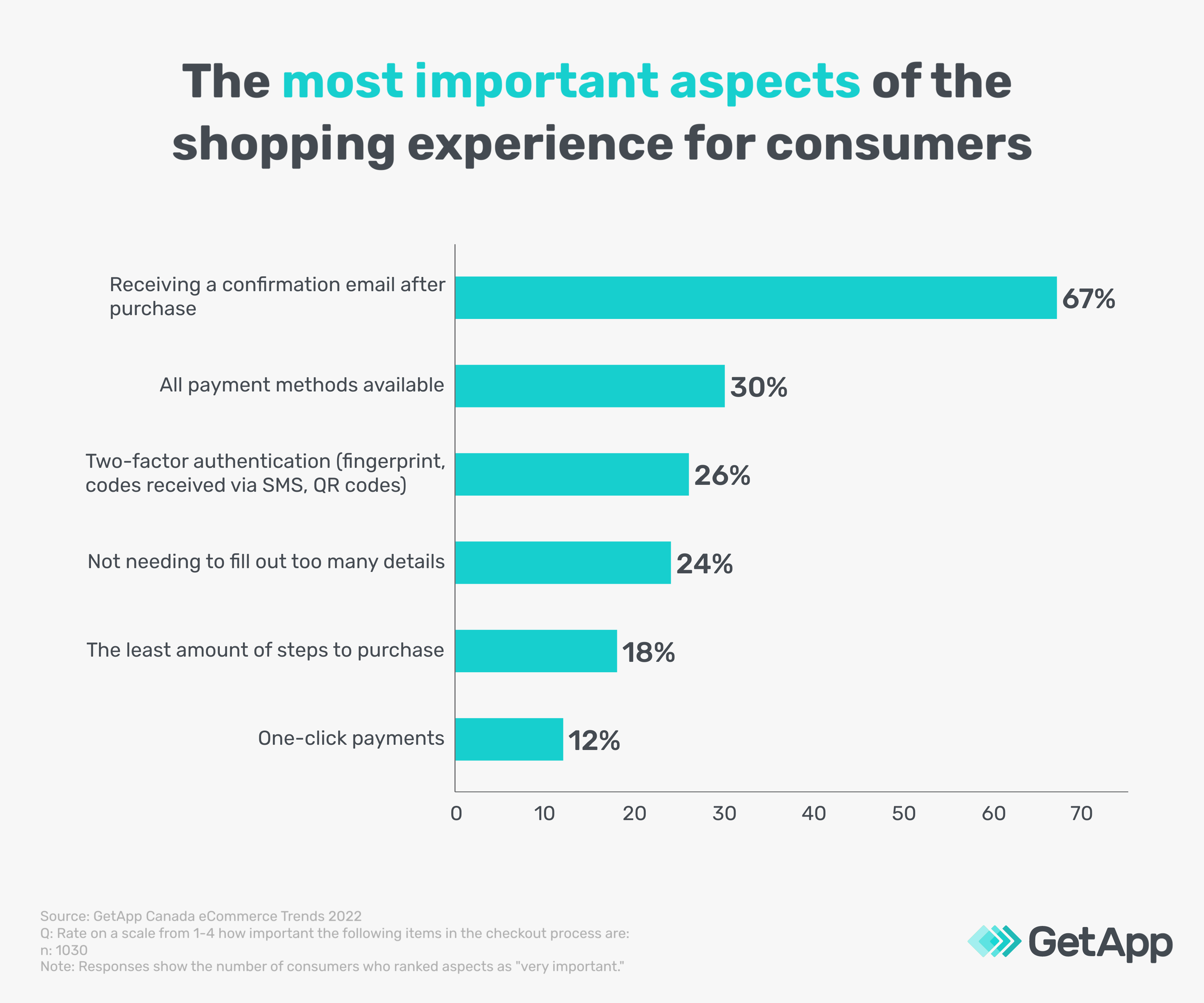

We asked consumers to rate how important various aspects of the online shopping experience are to them. The most valued, rated by 67% as ‘very important, was surprisingly simple: a confirmation email after purchase.

Other noteworthy findings were the fact that consumers were most likely to rate one-click payments as ‘not important’, and the fact that 62% consider the additional security of two-factor authentication to be ‘quite’ or ‘very important’ when shopping online.

What do consumers look for in a checkout process?

It is easy to think of retail as being ‘all about the product’, but our research reveals that payment is highly important for consumers in Canada —especially online. Less than half (48%) say they would continue with a transaction if their preferred payment method was not available. One-quarter (25%), however, said they would stop the process and not buy the product, while a similar proportion (24%) would look for the product on a different site.

Many stores will offer to save customer details so they don’t have to enter their data again when making future purchases, but customers must trust the stores to keep their data safe. 70% of the consumers in our survey said they save their data for a smoother checkout process — 13% always, 20% most of the time, and 36% only sometimes.

Of those who save their payment details, many take advantage of one-click transactions, where they can buy items using their saved payment and delivery data to avoid having to re-enter it at the checkout. 9% always use this option, 18% do so most of the time, and 35% only sometimes.

Consumers still have concerns over online payments

Even though it has been a mainstream activity for some two decades now (Amazon’s IPO was in 1997), online shopping remains a remote experience. Perhaps this is why many consumers still have some misgivings. Nearly half (46%) say they are concerned about online payments (versus 54% who say they are not).

Among those who are concerned, the biggest worries include fraud (83%), hacking (82%), and additional charges (37%).

29% of consumers have fallen victim to fraud

We asked all respondents to our survey about their experiences with online payments to see how prevalent these issues are in reality.

29% said they had been the victims of fraud from an online shop in the past ten years. This was most likely to take the form of a store selling fake products, with 32% of those having experienced fraud reporting this method. But consumers experienced many other types of fraud. One-quarter (25%) said they had used a fake store impersonating a real store or brand they were familiar with, while 22% said they had been tricked by a fake advertisement on a real website.

Most victims of fraud in our survey (54%) got their money back after reporting the incident to their bank or credit card provider, and 18% managed to reclaim their funds after complaining to the store. But 25% were left out of pocket following the incident.

Hacking affects one in four online shoppers

Just over one-quarter (26%) of consumers in our survey have been victims of hacking in the past ten years. In many cases, the hacking method used was a data breach of a vendor website or database that had consumers’ payment data saved. This was the most common occurrence, reported by 35% of hacking victims.

Phishing emails (15%) and fake pages inviting people to enter their payment details (12%) were also commonly reported scams. But nearly one-third (32%) of hacking victims said they did not know how the attackers got their details. This lack of understanding of how cyber criminals operate —even among people who know they have been victims— perhaps explains the lingering concerns about online shopping and payments found across consumers in Canada as a whole.

Being defrauded or losing data to hackers significantly affects people’s future willingness to shop online. 29% of fraud victims and 27% of hack victims say they buy online less frequently following their experiences.

How do shoppers stay safe online?

A huge majority of consumers —some 92%— have some degree of concern about security when shopping online. 54% are only ‘slightly concerned’, but 27% and 11% are ‘quite’ and ‘very’ concerned respectively.

Our research shows that online consumers do take steps to protect themselves and their data. Most stick with suppliers they believe to be safe, with 56% saying they only use trusted or well-known retailers, and 45% saying ‘I judge based on reputation of the online shop’. 40% go by security measures, saying that they check if the website is encrypted with SSL (a lock sign before the URL). And 40% make their decisions based on reviews from other shoppers on third-party review sites.

Similarly, many shoppers use software to protect their devices and data. 49% say they use antivirus software, and 34% use ad blockers, but 38% say they don’t use any such tools.

In summary

This research indicates that online shoppers in Canada are comfortable using a wide variety of online shopping platforms and payment types, and that they are broadly aware of security risks when doing so. It also points to high consumer expectations when it comes to user experience, ease of transactions, and data protection.

SMEs looking to grow their eCommerce business should consider steps to streamline transactions, offer a wide variety of payment types, and demonstrate their trustworthiness to customers.

In the next article in this series, we will explore more of this research, focusing specifically on buy now, pay later services.

Methodology:

To collect data for this report, GetApp conducted an online survey in April 2022. Of the total participants, we were able to identify 1,030 respondents who fit the following criteria:

- Canadian resident

- Between 18- and 75-years old

- Shop online at least once every month