With the rapid growth of technology trends in the retail industry, many SMEs are wondering about the future of retail. To help businesses evaluate the usefulness of these trends, we’ve examined consumer sentiments regarding recent shopping trends such as SMS marketing and eCommerce options.

What we will cover

While online grocery shopping initially surged due to the COVID-19 pandemic, some sources say that these habits will continue post-pandemic. It seems customers have gotten used to using digital tools during shopping experiences: most Canadian respondents to our recent retail technology survey are interested in trying out new services such as checkout-less shopping, examined in detail in our first article in this series.

Despite the hype around some retail tech trends, SME owners should consider their customer base as well as current infrastructure before implementing new services. To provide necessary context for these decisions, GetApp conducted a survey of more than 1,000 Canadian grocery shoppers who live in urban or suburban areas (scroll to the bottom for full methodology) to ask about checkout-less shopping, text-to-shop, and other trends.

Which trends are being considered in the future of retail?

Some trends may be more or less apt to certain types of retail, so a case-by-case analysis is needed before making any commitments. The examples we used in our survey consist of emerging trends that are slowly arriving to Canada’s retail landscape. While they may not all be ready for wide-scale implementation, monitoring these trends could help SMEs adopt the most accessible features.

Checkout-less shopping

More thoroughly defined in our first article, checkout-less shopping asks customers to download a smartphone app to enter the store, where they can complete purchases either by self-scanning items or simply walking out. As they already exist in stores like Aisle24 and 7-Eleven, it’s no surprise that 58% of Canadians surveyed have heard of them. A further 5% have seen such a store near them, and 4% have already shopped in one, signaling a wide awareness of the technology.

The high awareness of cashierless technology could be due to the current availability of these stores, and could also be why of the 977 survey takers interested in checkout-less shopping, most (86%) would want to use it in grocery stores. Convenience stores, clothing stores, and department stores are also amongst the top choices for checkout-less service.

Although it seems that consumers would be ready to try a variety of checkout-free shops, their habits might suggest otherwise. Cashierless shopping eliminates the option of a human cashier, yet the majority of respondents (51%) are only used to using self-checkouts some of the time. Furthermore, 18% admit to preferring human cashiers, showing that some shoppers may not be inclined to use cashierless stores.

Text-to-shop

The text-to-shop technology allows customers to make purchases without looking up from their phone. With text-to-shop services, users create profiles with certain stores or brands, registering their phone number, address, and billing details. Once registered, customers receive offers and deals via text message, and can make purchases by replying to the SMS. From there, products are shipped to the customer’s home address.

While text-to-shop is being considered by some sizable retailers, fewer Canadian respondents were interested in trying this technology than checkout-less shopping. Only 60% of survey takers showed interest in text-to-shop buying, while 79% were interested in cashierless stores. Unsurprisingly, age also played a factor in interest, with 71% of respondents of ages 18 to 25 showing interest compared to only 50% of those 56 to 65 as interested.

Of those open to text-to-shop technology, over half (55%) said the most important advantage would be the ease of making purchases. The ease of purchasing through text-to-shop may be partially due to the retailer’s access to a buyer’s personal data, such as order history and product searches. While 69% of all respondents admit the usefulness of a store suggesting products based on personal information, 31% feel uncomfortable or unsure of this practice.

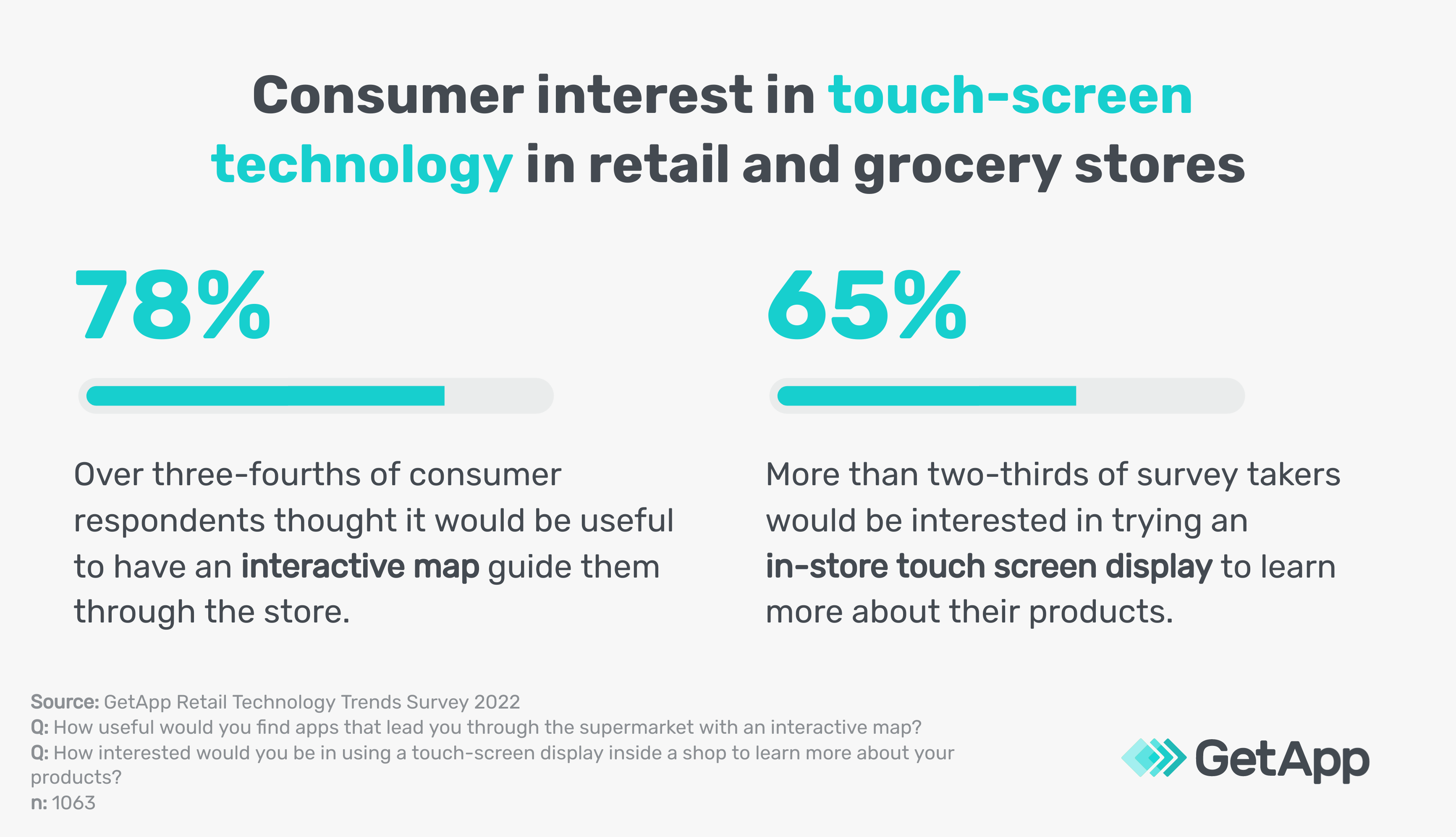

Interactive screens

As explained in our prior article on retail technology, some customers may find it harder to adapt to new ways of shopping. For those who may need extra guidance, interactive maps and other screens could help. Over three out of four (78%) survey respondents would find it useful to have an interactive map that guides them through a physical store.

In stores with few to no in-store staff to answer questions or offer recommendations, touch screens can help customers with more than aisle numbers and item locations. They could also serve to inform customers about products, a feature which nearly two out of three (65%) shoppers showed interest in.

Grocery store apps

Customer reactions to text-to-shop technology could hint at their readiness to interact with stores via smartphone. It’s likely that the future of retail will incorporate smartphone apps into the customer experience, as 40% of respondents are already using at least one smartphone app to help with product selection in grocery stores. Though all survey-takers own smartphones, over 88% of Canadians own smartphones as well; the high smartphone ownership here may play a role in grocery store app usage.

To understand how to give app-using shoppers a pleasant customer experience, their needs must be considered. According to our survey, 35% of shoppers would find product reviews from other customers to be the most useful aspect of a retail app. Being able to read a product’s full list of ingredients was seen as most useful by 31% of those surveyed.

Despite most respondents finding some aspect of grocery store apps useful, not all shoppers do. One respondent voiced a specific opinion on this, saying they were “not useful if it means losing privacy.”

Data privacy concerns over new retail technology

When it comes to newly introduced retail technology, some consumers may be worried about data privacy issues. However, different trends garner different levels of concern regarding data safety and cybersecurity.

For example, over half (52%) of respondents cited being hacked as a concern of theirs when using checkout-less stores. However, only one in three respondents (39%) had similar concerns of having their data hacked while using text-to-shop technologies. Following this perceived downside of text shopping, a further 38% said being scammed or phished was also a main concern.

Key considerations

Although some retail trends may still be a long way away from widespread implementation, it’s important to keep an eye on the industry trends that consumers readily adopt. Watching their interactions with new trends as well as getting to know their concerns, priorities, and demographics can help SMEs keep customers at the focus of business decisions.

Before implementing significant technology changes, consider these takeaways:

- The majority of respondents show interest in checkout-free shopping, but may not be ready for a fully employee-less shopping experience.

- Younger respondents and those with more online shopping experience show the most interest in text-to-shop technology.

- Most Canadian respondents find in-store screens useful and interesting for store directions and product information.

- Grocery store apps could be useful for nearly half of survey respondents, with product reviews and ingredients rated as most useful.

- While respondents show interest in many different retail technologies, data privacy concerns inform a need to follow best cybersecurity practices.

Identifying and evaluating the technology trends most adapted to their audience and accessible for their business enables SMEs to plan for the future and stay ahead of the curve.

Note: The applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.

Survey methodology:

To collect the data for this report, we conducted an online survey in January and February 2022. The survey was sent to 1,350 people, of which 1,063 were selected to participate. The sample of participants is representative of the population of Canada regarding aspects of age and gender, and the criteria for selecting participants are as follows:

- Canadian resident

- Over 18 years old

- Must physically shop for groceries at least once a month or more

- Lives in either an urban or suburban area

- Has a smartphone

- Must be able to correctly identify one feature of checkout-free shopping out of three possible answers after being provided a definition and an explanatory video